Introduction

Warren Buffett, widely regarded as one of the most successful investors of all time, has made strategic adjustments to his investment portfolio over the years. One of the notable shifts in his portfolio includes his position in Apple Inc., the tech giant that has become a cornerstone of many investors’ portfolios.

1. Assessing Market Trends:

In the dynamic landscape of the stock market, Warren Buffett begins by meticulously analysing prevailing market trends related to Apple’s performance and broader economic indicators.

2. Evaluating Apple’s Fundamentals:

Buffett’s investment decisions are grounded in fundamental analysis. He assesses Apple’s financial health, including revenue growth, profit margins, and market share dynamics.

3. Monitoring Technological Innovations:

Given Apple’s position as a technology giant, Warren Buffett stays abreast of emerging technological innovations and their potential impact on the company’s future prospects.

4. Reviewing Competitive Landscape:

Buffett pays close attention to Apple’s competitors, gauging their strategies, market positioning, and innovations to anticipate competitive threats and opportunities.

5. Considering Macroeconomic Factors:

Macroeconomic factors, such as interest rates, inflation, and geopolitical events, play a crucial role in Buffett’s decision-making process regarding his Apple holdings.

6. Balancing Portfolio Diversification:

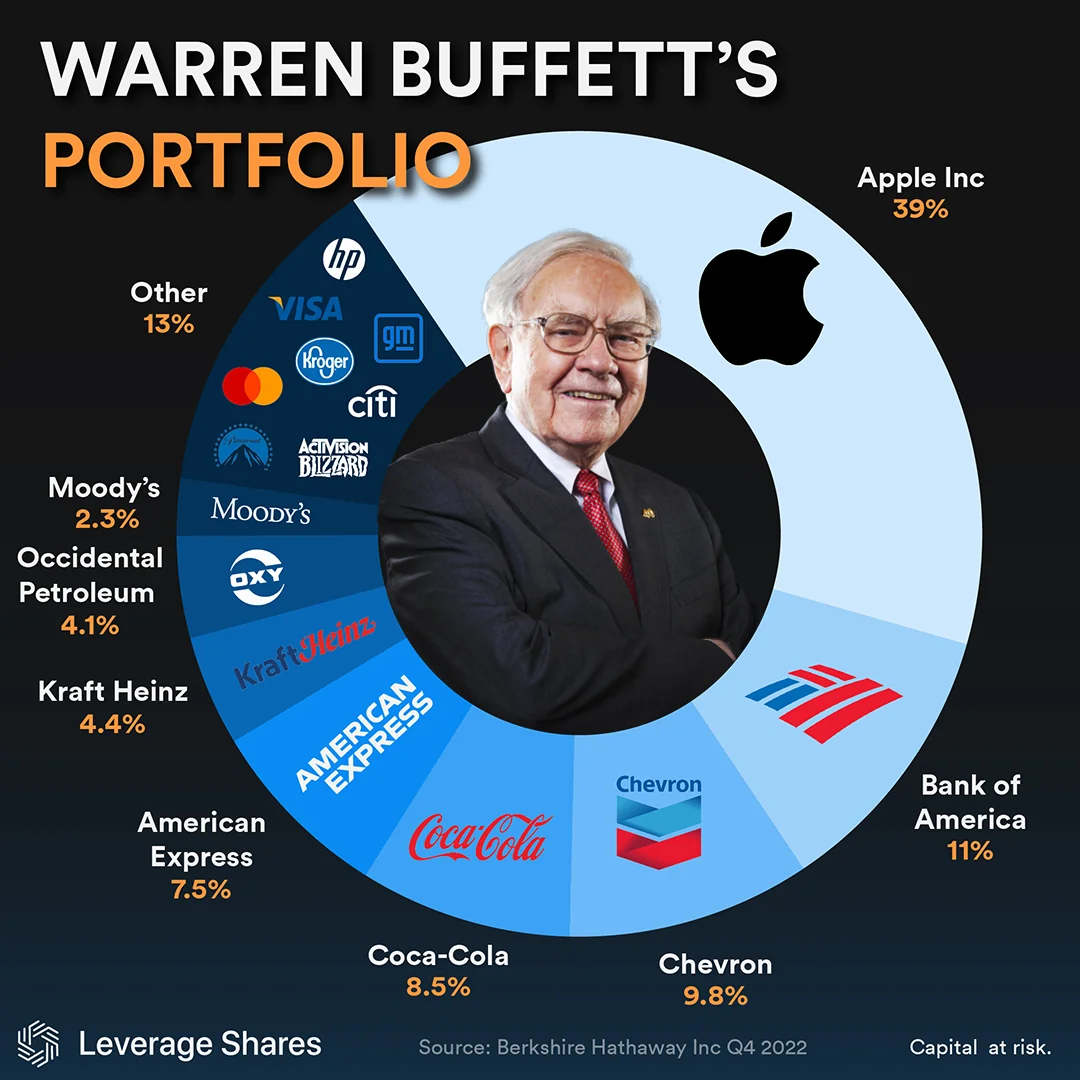

As a proponent of portfolio diversification, Warren Buffett ensures that adjustments to his Apple position align with the overall diversification strategy of his investment portfolio.

7. Long-Term Investment Perspective:

Buffett maintains a long-term investment perspective, prioritising the intrinsic value of Apple’s business over short-term market fluctuations.

8. Capital Allocation Strategies:

Effective capital allocation is paramount for Warren Buffett. He evaluates the opportunity cost of retaining or reducing his Apple holdings relative to alternative investment opportunities.

9. Risk Management Measures:

While confident in Apple’s prospects, Buffett implements risk management measures to mitigate downside risks associated with his investment in the tech giant.

10. Communicating with Shareholders:

Warren Buffett believes in transparency and effective communication with shareholders. He may articulate his rationale behind adjustments to his Apple position through shareholder letters or public statements.

Warren Buffett’s Initial Investment in Apple

Buffett’s initial foray into Apple began in 2016 when Berkshire Hathaway started acquiring shares of the company. Despite his historical preference for value stocks, Buffett recognised Apple’s strong brand, loyal customer base, and innovative product lineup as compelling investment attributes.

Factors Influencing Buffett’s Decision-Making Process

Buffett’s investment decisions are influenced by various factors, including the company’s financial performance, management quality, competitive positioning, and long-term growth prospects. Additionally, macroeconomic trends and market dynamics play a crucial role in shaping Buffett’s investment thesis.

Recent Developments Affecting Apple’s Position in Buffett’s Portfolio

In recent years, Apple has experienced significant growth driven by robust iPhone sales, expansion into services such as Apple Music and i Cloud, and the introduction of innovative products like the Apple Watch and Air Pods. These developments have further solidified Apple’s position as a market leader in the technology sector.

Changes in Buffett’s Apple Position

Despite initially expressing scepticism about investing in technology companies, Buffett gradually increased Berkshire Hathaway’s stake in Apple, indicating his growing confidence in the company’s long-term prospects. However, Warren Buffett recent actions suggest a departure from his traditional buy-and-hold strategy.

Reasons Behind Buffett’s Adjustments

Buffett’s decision to adjust his Apple position may stem from various factors, including changes in Apple’s valuation, shifts in market sentiment, and evolving industry dynamics. Additionally, Buffett’s emphasis on value investing principles may lead him to reassess his portfolio allocations periodically.

Analysis of Buffett’s Investment Philosophy

Buffett’s investment philosophy emphasises the importance of patience, discipline, and a long-term perspective. While he remains committed to his value investing principles, Buffett also adapts to changing market conditions and seeks opportunities that offer favourable risk-reward profiles.

Potential Impact on Apple and Berkshire Hathaway

Buffett’s actions regarding his Apple position could have implications for both Apple and Berkshire Hathaway shareholders. Depending on the magnitude and direction of Warren Buffett adjustments, these moves may influence market perceptions of Apple’s prospects and Berkshire Hathaway’s investment strategy.

Consideration of Market Trends and Competition

In the rapidly evolving technology landscape, Apple faces competition from both established players and emerging challengers. Buffett’s adjustments to his Apple position may reflect his assessment of competitive threats, technological innovation, and shifting consumer preferences within the industry.

Warren Buffett, widely regarded as one of the most successful investors of all time, has been known for his prudent investment strategies and long-term approach to stock picking. With his keen eye for value and a deep understanding of market dynamics, Buffett’s investment decisions are closely watched by investors worldwide. In recent times, there has been significant speculation regarding Buffett’s position in tech giant Apple Inc. Let’s delve into how Warren Buffett is adjusting his Apple position at this time.

Introduction to Warren Buffett’s Investment Strategy

Warren Buffett, the chairman and CEO of Berkshire Hathaway, has built his investment empire on the principles of value investing. He seeks out companies with strong fundamentals, sustainable competitive advantages, and competent management teams, aiming to hold onto these investments for the long haul.

Warren Buffett’s Initial Investment in Apple

Buffett’s foray into Apple began in 2016 when Berkshire Hathaway disclosed a sizeable stake in the tech company. Initially, Buffett was cautious about investing in technology companies, but Apple’s robust financials, loyal customer base, and innovative products caught his attention.

Analysis of Warren Buffett’s Apple Position

Over the years, Buffett steadily increased Berkshire Hathaway’s holdings in Apple, signalling his confidence in the company’s future prospects. Apple’s consistent revenue growth, expanding ecosystem, and strong brand resonance align with Buffett’s investment philosophy.

Recent Developments Impacting Buffett’s Apple Position

In recent months, there have been speculations about Buffett trimming Berkshire Hathaway’s Apple holdings. Several factors could be influencing this decision, including changes in Apple’s business dynamics, market volatility, and portfolio re balancing strategies.

Factors Influencing Buffett’s Decision-Making Process

Buffett’s decision-making process is guided by a thorough analysis of company fundamentals, market trends, and macroeconomic factors. He remains pragmatic in his approach, adjusting his portfolio based on changing circumstances and valuation metrics.

Buffett’s Approach to Portfolio Management

Buffett advocates for a concentrated portfolio of high-quality businesses that he understands well. While Apple has been a significant holding in Berkshire Hathaway’s portfolio, Buffett emphasises the importance of staying rational and unemotional when managing investments.

Potential Implications of Buffett Adjusting His Apple Position

Buffett’s decision to adjust his Apple position could have broader implications for both Berkshire Hathaway’s portfolio and the broader market. It may signal a shift in sentiment towards tech stocks or reflect Buffett’s assessment of Apple’s growth prospects.

Market Reactions and Investor Sentiments

Any updates on Warren Buffett Apple position are closely monitored by investors and analysts alike. Changes in Berkshire Hathaway’s holdings often lead to fluctuations in Apple’s stock price and can influence overall market sentiment.

Expert Opinions on Buffett’s Investment Moves

Financial experts and market commentators offer diverse perspectives on Buffett’s investment moves. While some view his adjustments as strategic portfolio management, others scrutinise his decisions for insights into broader market trends.

Conclusion

Warren Buffett decision-making process regarding his Apple position underscores the importance of diligence, patience, and adaptability in investment management. As markets evolve and dynamics shift, Buffett remains committed to his core investment principles while adjusting his portfolio to seize opportunities and manage risks effectively.